On January 31, 2023, the European Banking Authority (EBA) published new Implementing Technical Standards (ITS) for interest rate risk in the banking book (IRRBB) reporting for public consultation. The consultation period will end on May 2, 2023, and comments can be submitted through the EBA’s website. The updated reporting framework is centered around the principle of proportionality, with the aim of tailoring reporting requirements more effectively to the size and risk profile of individual financial institutions. Simplified reporting templates are proposed for small and non-complex institutions (SNCIs) as defined in Article 4(145) of CRR2.

Issues related to IRRBB regulation are currently topical. In October 2022, the EBA published final guidelines and standards for managing IRRBB, which we covered in an earlier article on our website.

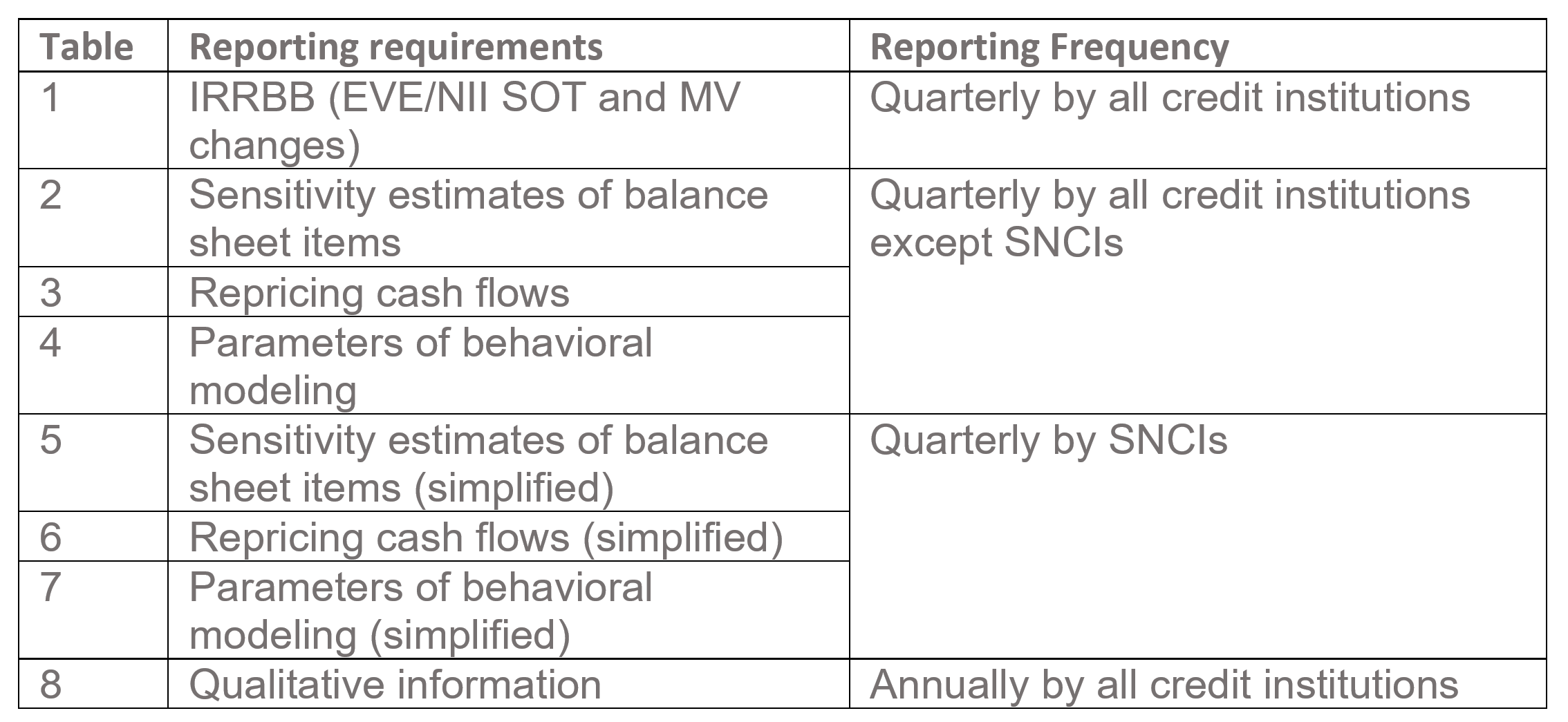

Article 1 of the ITS draft states that IRRBB data will be reported in accordance with the Capital Requirements Directive (CRD), and credit institutions will be required to submit the following information in the tables below:

- The first table collects information on (a) net interest income and economic value of equity in Supervisory Outlier Test (SOT) (b) market value changes for baseline and -/+ 200 bps shock scenarios.

- The second table collects information on the sensitivity of asset and liability items on the balance sheet to different shock scenarios (EVE/NII SOT and MV changes).

- The third table collects information on the same balance sheet items as the second table: (a) weighted average yield and remaining maturity, (b) exposure/carrying amount and information on behavioral modeling and automatic optionality, and (c) re-pricing cash flows divided into 19 different time buckets.

- The fourth table collects EVE-related information on the average re-pricing date for the following balance sheet items, taking into account contract factors and different behavioral modeling scenarios: non-maturity deposits (NMDs), fixed-rate loans (subject to prepayment risk), and time deposits (subject to early withdrawal risk).

- Tables 5-7 concern small and non-complex institutions and collect similar information as tables 2-4, but in a simplified manner. In practice, the content is otherwise identical to the above-described tables, but the balance sheet items are examined at a higher level rather than in detailed breakdowns.

- The eighth table collects qualitative information annually with 21 predetermined question and answer options. The purpose is to gather additional information on the values reported in the other tables, such as the assumptions used in the calculations and yield curves. The coverage of qualitative data collection may still change after the consultation process.

After the consultation period, the final ITS draft will be submitted by the EBA to the European Commission, which will take place in mid-2023. In addition, the EBA will develop Data Point Model (DPM), XBRL taxonomy, and validation rules based on the final draft. The implementation period for the change is currently estimated to last one year, and it is expected to begin in June 2024 (EBA DPM 3.4). The new IRRBB reporting will also be in the development pipeline for our DPM Manager tool.

Sources: